PolyMet & Glencore

WaterLegacy’s appeal of the PolyMet permit to mine asked the Minnesota Court of Appeals to require that a contested case hearing on the permit review whether Glencore should be named on the PolyMet permit to mine.

While appeals of the DNR permit to mine were pending, Glencore purchased a 72% controlling interest in PolyMet and assumed the power to take over PolyMet’s board at any time. On January 13, 2020, in its opinion overturning the PolyMet permit to mine and requiring contested case hearings, the Minnesota Court of Appeals specifically ruled that the required contested case hearings should examine whether Glencore should be named on the PolyMet permit to mine.

Why should we care if Glencore controls the PolyMet mine?

Labor Abuses & Financial Exploitation

Glencore is notorious as one of the worst corporations in the world for labor abuses and financial exploitation of the communities in which its mines are located.

- Glencore was identified at the World Economic Forum in 2013 as one of the worst corporations in the world for environmental and human rights abuses.

-

In a 2014 summary of Glencore’s anti-union behavior, global unions representing Glencore workers reported widespread abuse of workers. Examples included:

A police officer takes aim at an indigenous woman protesting a Glencore mine in Peru in May 2012. Photo by Miguel Gutierrez.

- In Peru, workers at the Antamina mine were subjected to health and safety violations on a regular basis and were denied fair payment for bonuses and overtime.

- In Australia, Glencore refused to re-hire former employees at the Collinsville mine who were union members and evicted the former workers and their families from company housing.

- In Colombia, a paramilitary group responsible for murdering trade unionists trained at a camp located inside a Glencore mine.

- In 2015, members of the United Steelworkers union ranked Glencore the world’s second-worst corporation in terms of lifetime corporate irresponsibility. They stated:

Glencore is truly deserving of this recognition as one of the most irresponsible companies on the planet… Glencore has mistreated workers and harmed communities on nearly every continent.

- In 2018, a coalition of industrial unions representing Glencore workers in Argentina, Australia, Bolivia, Canada, Chile, Colombia, the Democratic Republic of the Congo, Germany, Italy, Norway, Peru, South Africa, the United Kingdom, and Zambia put together a Special Report: Glencore, the commodities giant with no soul. The Report emphasized financial exploitation as well as human rights abuses:

Toxic Pollution & Evasion of Responsibility

Glencore has caused toxic pollution and has sought to evade responsibility for pollution clean-up on several continents.

- WaterLegacy’s PolyMet & Glencore report summarized Glencore’s environmental history, which includes fish kills and drinking water contamination resulting in hospitalizations of 800 people at Glencore’s Mopani mine in Zambia and an unfunded pollution liability of $411 million left behind at Glencore’s Metaleurop copper processing subsidiary in France.

- In 2017, Glencore proposed to massively expand its controversial McArthur River lead and zinc mine in Australia. Glencore proposed that responsibility for the mine site would revert to the government just 50 or 100 years into a rehabilitation and monitoring process expected to take 1,000 years.

Bribery & Corruption

Glencore has a long and continuing history of bribery and corruption.

- In 2018, the U.S. Department of Justice launched an investigation of Glencore for money-laundering and violation of the Foreign Corrupt Practices Act.

- Glencore has also been under scrutiny for circumventing U.S. sanctions against Russia. Glencore participated in a deal where Glencore and Qatar provided Russia with a huge cash infusion by temporarily “buying” an $11.5 billion stake in Russia’s state-owned oil company.

- In July 2018, shareholders filed a lawsuit against Glencore for losses due to failure to disclose U.S. Department of Justice investigations. On January 7, 2020, the shareholders filed an amended class action complaint, which Glencore is now seeking to dismiss. Among other claims, the amended class action complaint against Glencore alleges:

Glencore engaged in corrupt practices and illegal payments in the DRC [Democratic Republic of the Congo], Venezuela, and Nigeria that subjected Glencore to increased risks of scrutiny by U.S. and foreign government bodies . . . The risk resulted in investigations into Glencore’s compliance with money laundering and bribery laws, as well as the Foreign Corrupt Practices Act. While the U.S. Foreign Corrupt Practices Act makes it a crime for companies to bribe overseas officials to win business, this practice was commonly used by Glencore to gain an economic advantage.

What do we know about Glencore’s control of PolyMet?

- Glencore owns all the rights to all products from the PolyMet sulfide mine and plant for the entire duration of mine production.

- Glencore advises PolyMet on finances, technical issues and detailed project design for the PolyMet mine project. By March 2018, Glencore had three members on PolyMet’s Board of Directors and a member on every PolyMet Board committee.

- From 2012 to 2018, projected NorthMet mine costs skyrocketed. At the same time, the rate of return has dropped by two-thirds, from 30.6% to around 10%, making PolyMet much less attractive to independent investors.

- The March 2018 Report acknowledged PolyMet’s dependence on Glencore for financing, stating that the risk that PolyMet’s mine project will fail due to failure to raise money “is partially mitigated through the company’s ongoing relationship with Glencore.” When the Report was filed, Glencore had options to buy up to 40% of PolyMet stock.

On June 27, 2019, the Star Tribune reported that Glencore’s ownership of PolyMet had increased from 29% to a 72% majority ownership.

She said she’s concerned that Glencore is not on any of the PolyMet permits, nor does the name “Glencore” appear in the financial assurance deal the state signed with PolyMet in its permit to mine. “Glencore is not responsible for any (of PolyMet’s) mine treatment, financial assurance or any liability for mine toxic pollution or a catastrophic dam failure at the tailings waste disposal facility,” Maccabee said.

What can you do?

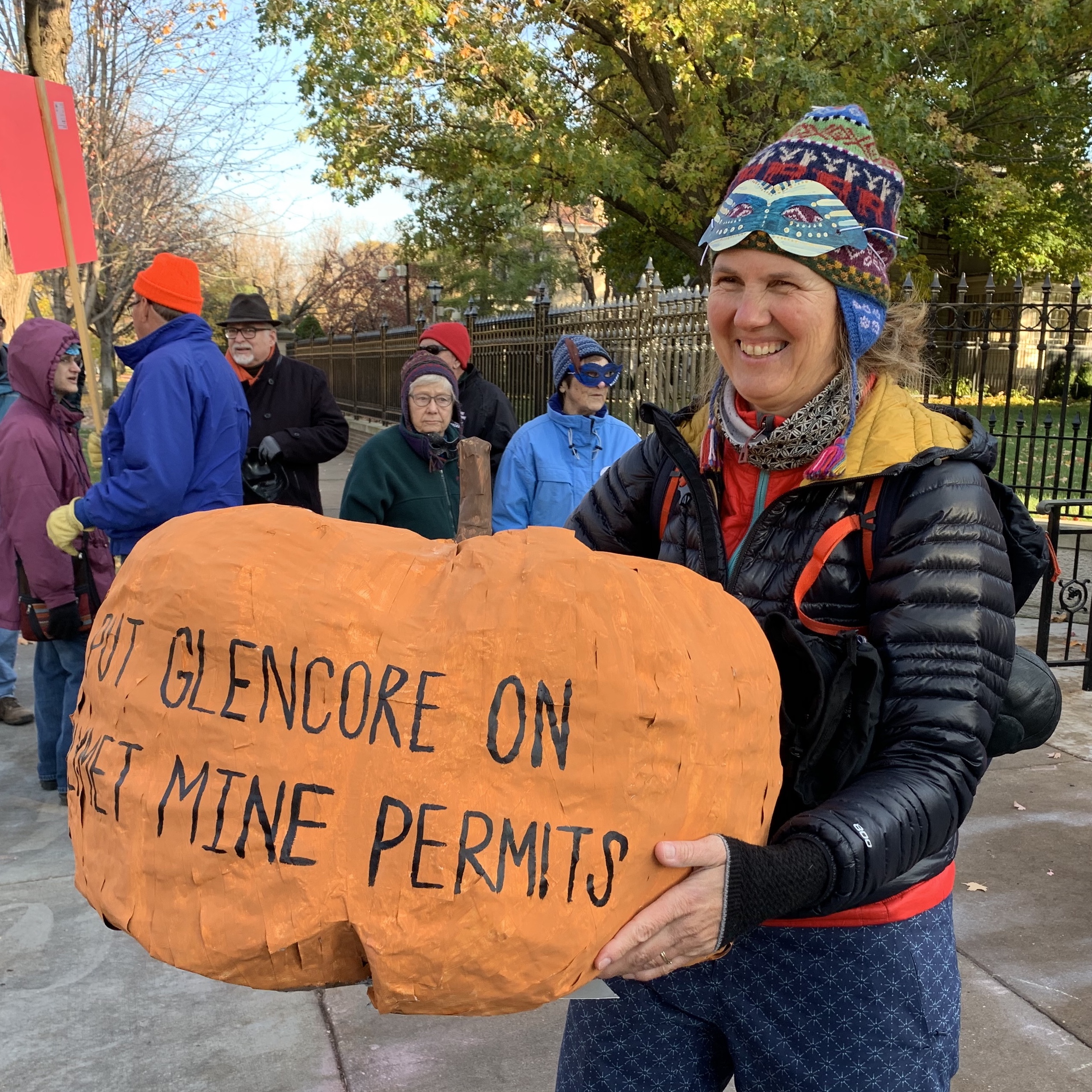

WaterLegacy supporters have submitted over 550 comments, emails and petitions calling for scrutiny of Glencore and requesting that Minnesota require that Glencore be named and financially accountable on any PolyMet permit to mine.

You can continue to communicate this message to Governor Tim Walz. Paste the following text or draft your own variation: